Healthcare companies are often modeled one of two ways: fee-for-service or value-based. Both refer to the way providers are paid. Knowing whether your primary care physician follows the fee-for-service model, or the value-based model can make a huge difference in your level of care. What is the difference between the two and why is that important?

Fee-for-service

Fee-for-service is the traditional model in terms of how physicians are paid and approximately 70% of providers still use this model. This means that healthcare providers get paid based on how many services are performed. These services could include in-office exams, surgical procedures, tests and more. But what does this mean for Medicare beneficiaries? Essentially, healthcare providers are paid according to the number of services they provide or tests they run. This could mean being shuffled out of the office to make time for the next patient. Fee-for-service puts an emphasis on the quantity of services provided rather than quality of care.

Seeing a physician that follows a fee-for-service program means that you may be paying more money for a doctor to run potentially unnecessary tests or services in order to find an answer to any medical issues that arise.

Value-based providers

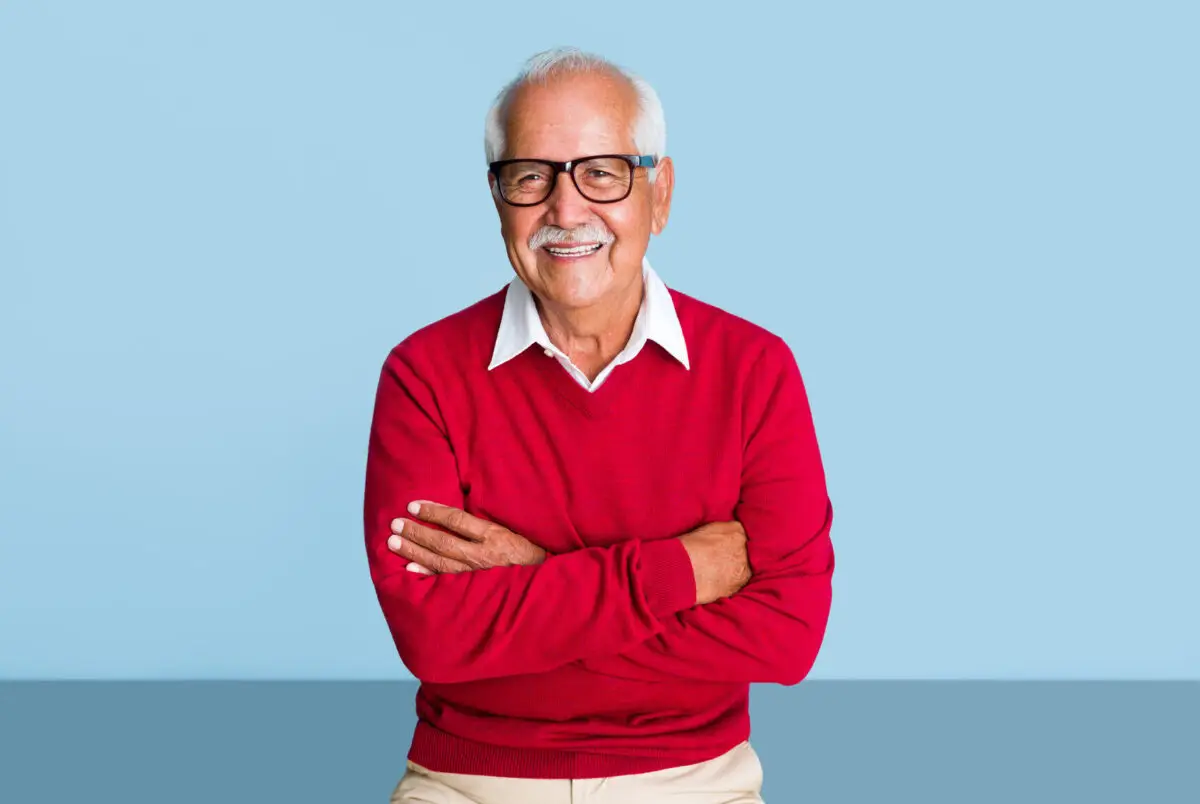

In contrast to fee-for-service based plans, value-based programs incentivize physicians by paying for the quality of care provided over the quantity of services. The goal is to keep patients from getting sick, instead of only treating patients once they are sick.

Value-based care plans allow medical professionals to be rewarded when focusing on the individual needs of each patient. Why is this important? If value-based providers are not paid due to the number of services provided, then they can spend time focusing on preventative care that allows beneficiaries to stay healthy and out of the hospital. Not to mention, the focus on preventative care often leads patients to spend less money out-of-pocket.

If you mention your skin concerns in an appointment with your primary care physician, they may be able to refer you to a dermatologist who is accepting new patients or is in your insurance network.

Are You Eligible for a Medicare Advantage Plan with Additional Benefits?

Get a Free Quote from a Licensed Insurance Agent.

Enrollment Eligibility

Annual Enrollment Period (AEP)

Medicare Annual Enrollment Period runs each year from October 15 to December 7. What is the Annual Enrollment Period vs. Open Enrollment Period?

Initial Enrollment Period (IEP)

Your Initial Enrollment Period generally surrounds your 65th birthday but may occur if you otherwise become eligible for Medicare for the first time.

Special Enrollment Period (SEP)

You may be eligible if you experience a qualifying life event such as moving to a new zip code, losing employer coverage, or change in Medicaid status.

Speak to a Licensed Insurance Agent Today

1-844-735-2912 / TTY

Aetna® Anthem® Cigna Healthcare® Humana® UnitedHealthcare®